Population trends in South-East Florida

A decade of growth, change, and new movers

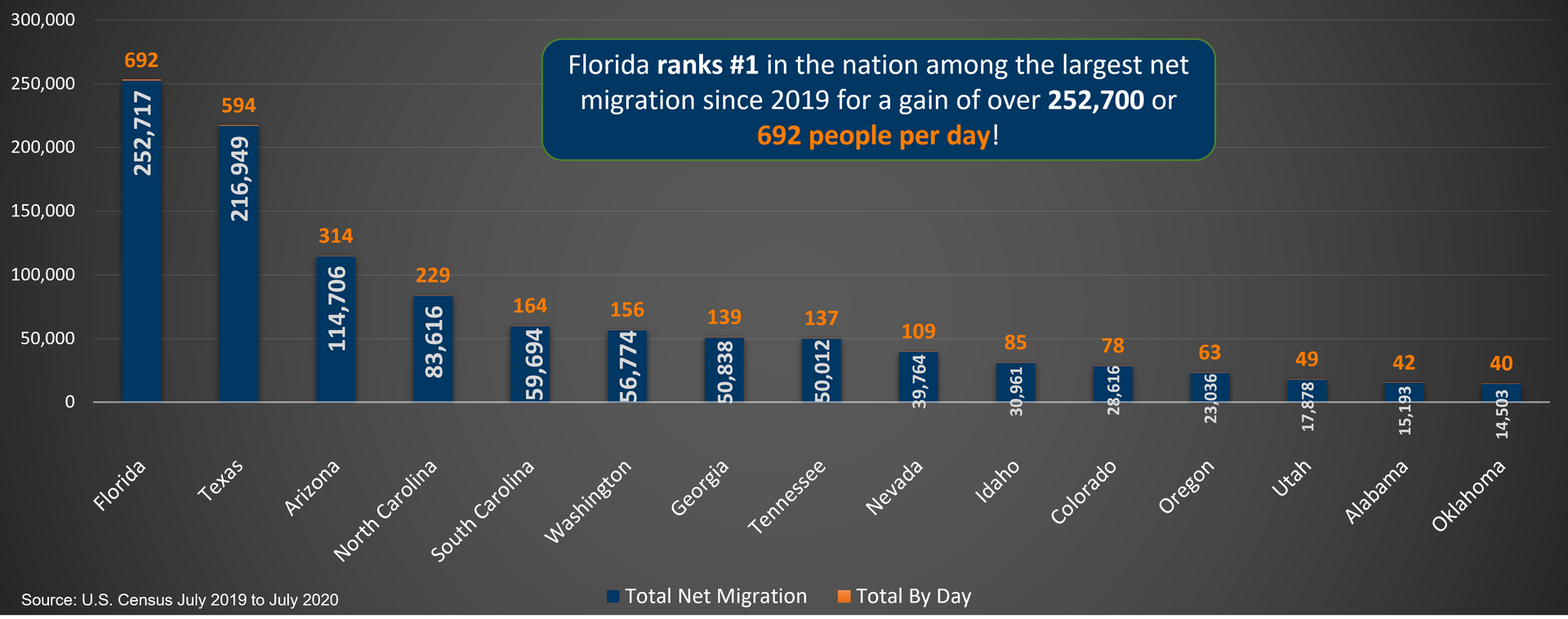

Over the past ten years South-East Florida — the tri-county area of Miami-Dade, Broward and Palm Beach — has quietly transformed into one of the nation’s fastest-growing and most dynamic metropolitan regions. Growth since the mid-2010s has been driven not by births but by movement: first a dramatic surge of domestic in-migration during and immediately after the pandemic, and more recently a steadier mix of international arrivals and selective domestic relocation. The result is faster population growth than the national average, shifting demographics, and important implications for housing, labor and infrastructure planning across the region.

How much did the population change?

County and regional estimates show clear gains. Statewide, Florida added hundreds of thousands of residents each year through much of the last decade; national and state estimates put Florida’s population increases in recent years in the hundreds of thousands annually, and the state surpassed 23 million residents in the mid-2020s. At the regional level, University of Florida and FIU research show that South-East Florida’s tri-county population rose from about 6.14 million in 2020 to over 6.27 million by 2023 (Bureau of Economic & Business Research/UF BEBR), and more recent 2024 estimates place the tri-county population nearer 6.45 million — a roughly 1.9% year-over-year increase for the metro area in the most recent vintage.

Looking at individual counties, the U.S. Census Bureau’s Vintage 2024 estimates show strong year-over-year gains for 2023–24: Miami-Dade (+2.3%), Broward (+1.7%) and Palm Beach (+1.6%). In Miami-Dade the increase was fueled largely by international migration plus a modest natural increase, while Broward and Palm Beach saw meaningful contributions from domestic movers as well as international arrivals.

Who’s moving in — and where are they coming from?

Two migration streams stand out over the last decade: international immigrants and Americans relocating from other states. International migration has become critical to Florida’s growth. National analyses and Census reporting show that in the most recent yearly estimates nearly half of Florida’s new residents arrived from abroad, reversing years when domestic moves dominated growth patterns. South Florida — especially Miami-Dade — has been a principal beneficiary of that international flow.

From a domestic perspective, the early-pandemic years (2020–22) saw outsized flows from higher-cost, higher-tax Northeastern and West Coast metros — New York City repeatedly ranks among the largest single-city contributors of new Floridians. That movement cooled after 2022 and has continued to moderate; by 2024 domestic net gains into Florida had declined from pandemic peaks, even as overall population growth remained positive thanks to international arrivals. In plain terms: the post-pandemic “rush south” eased, and new growth is now a blend of continued international arrivals and selective, economically motivated domestic migration.

Demographic shape: older, but diversifying

Florida’s reputation as a retirement destination remains true: the state has one of the highest shares of residents age 65+ in the country, and a substantial portion of in-migrants are retirees seeking climate, taxes, and lifestyle benefits. Yet the inflow of international immigrants — many of them younger working-age adults — is reshaping the age profile in pockets of the region, especially in immigrant-dense neighborhoods in Miami-Dade. The net effect is greater age-diversity across the metro: older suburban inflows in some communities, and younger, often immigrant labor forces in urban centers and service sectors.

Rapid population growth compresses housing supply and puts upward pressure on rents and home prices — a trend South-East Florida has experienced acutely in the last five years. The mixture of high-income domestic arrivals (a not-insignificant share during the early pandemic years) together with lower-wage international newcomers has widened housing demand at both ends of the market, increasing the need for both affordable workforce housing and higher-end inventory. Local planning documents and economic reports note rising demand for infrastructure, transit and social services to accommodate the growing and more diverse population.

What changed over the last 10 years — the big takeaways

- Scale and speed: South-East Florida grew faster than many U.S. metros, with multi-year gains that added hundreds of thousands of residents to the tri-county area since 2015. Bureau of Economic and Business Research

- Migration mix shifted: Early-pandemic domestic migration gave South Florida a big boost; since then, international migration has taken on a larger share of total growth, keeping population gains positive even as domestic flows cooled.

- Demographic complexity: The region is simultaneously aging in many suburban locales and gaining younger immigrants in urban neighborhoods, producing a more heterogeneous population with different needs. Brookings Institution

- Policy pressure points: Housing affordability, transportation, and public services are the clearest near-term challenges — local governments are grappling with how to match infrastructure to the new scale and speed of growth.

Looking forward

Expect the next several years to bring steadier — not explosive — growth. International migration will likely remain a principal engine, while domestic patterns will be shaped by economic conditions, remote-work policies, and affordability dynamics in the sending metros. For planners, investors and community leaders in South-East Florida, the priorities are clear: build more diverse housing, expand transit and utilities, and plan for a population that is both older in sections and younger and more international in others